|

Who Won the Battle Between Small and Large in 2023? |

1/2/2024 |

The Magnificent Seven drove large-cap performance, but what about the rest of the market -- and the SmallCap Informer picks?

It is common for the market to deliver mixed results for investors, with some segments performing well in a year and others offering underwhelming returns.

Even so, 2023’s overall performance seems particularly variegated, with select market categories turning in turbocharged results and others trailing far behind.

The big story is the performance of the mega-cap Magnificent Seven” stocks (Apple, Microsoft, Google, Amazon, Meta, Tesla and Nvidia). While the S&P 500 ended 2023 near its all-time highs and up more than 25% for the year, more than 65% of the S&P 500 index’s total return came from just the seven largest companies in the index.

Each of these stocks saw their prices grow at least twice as much as the S&P 500 index did, and at least four times as much as the S&P 500 Equal Weighted index. The growth of these seven stocks was so great in the year that they now make up more than 25% of the S&P 500.

For many of the other 493 companies in the S&P 500—as well as mid-caps and small-caps—it was a much more mixed year.

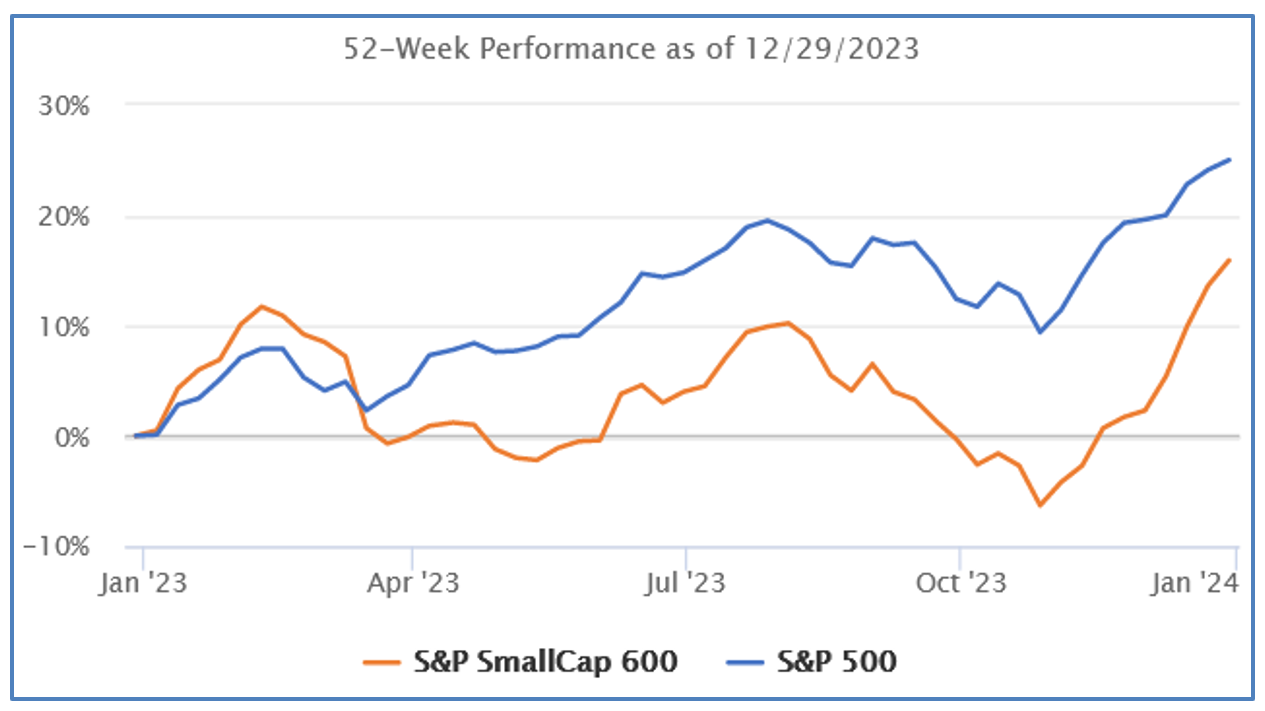

Small-cap stocks headed out of the gate quickly as the year began, but ceded the lead just after the first quarter began. A fourth quarter rally was not enough to for the S&P SmallCap 600 to catch up to their larger cousins, though the index was still able to end the year up a very respectable 14.4%:

This is not to say that small-cap stocks had a smooth time of it as the year rolled on. My commentary in the November 2023 SmallCap Informer, when small-caps had reached a trough, turned out to be prescient. I predicted that small-caps were due for a turnaround. A few days after the issue was published, small company stocks did indeed begin an upward run. In a space of just two months in November and December, the S&P SmallCap 600 went from the lowest levels of the year to its highest.

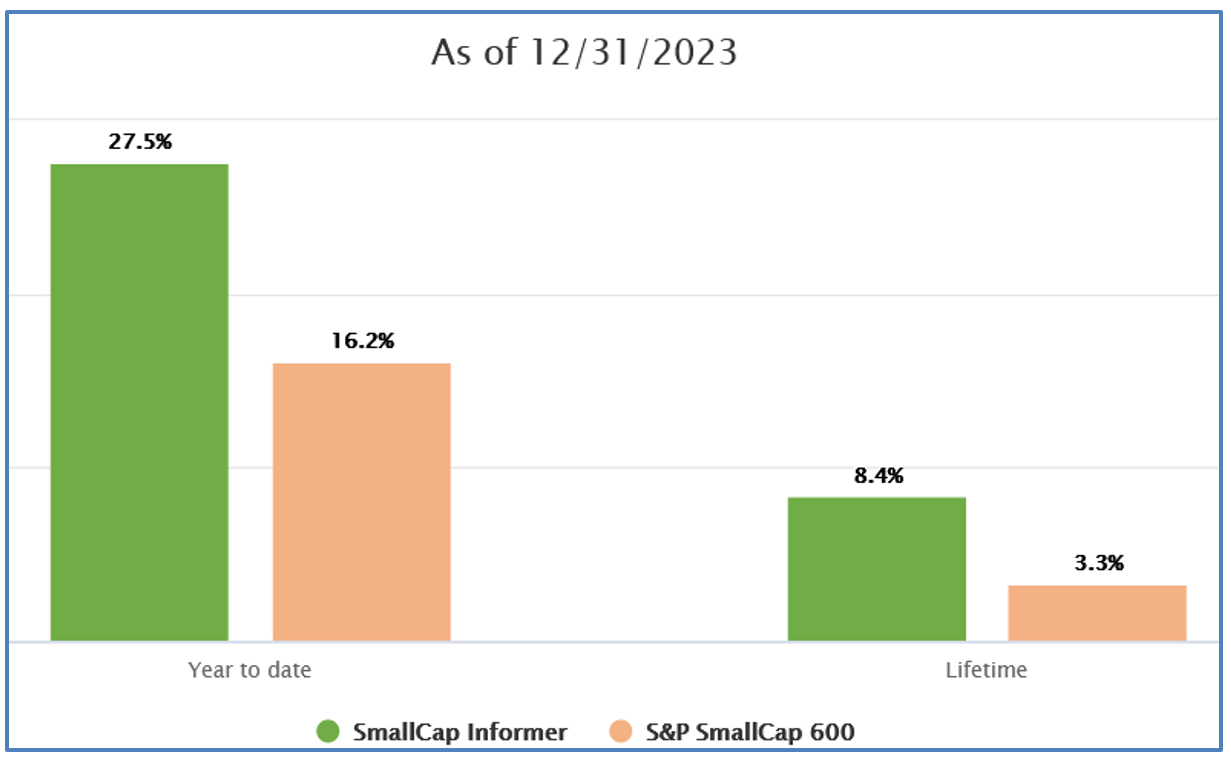

Results for companies covered in the SmallCap Informer were much better in the year than the overall index return. On a benchmarked basis, our covered companies delivered a 27.5% annualized rate of return for the year, compared to 16.2% for similar cash flows into the S&P SmallCap 600 index. Our lifetime results continue to exceed those of our target index, as well, demonstrating that an approach to stock selection focused on identifying excellent companies and paying reasonable prices for their stocks is a viable strategy for individual investors:

We are pleased that our methodology continues to perform and look forward to continued success in 2024.

* * *

As the banking industry adjusts and evolves in the ever-changing environment for interest rates in 2024, this particular sector may offer good opportunities for investors. In this issue of the SmallCap Informer we introduce a new small regional bank offering good potential returns at its current price.

On behalf of our entire team, we wish you the best for 2024. As always, stay the course!

- DOUG GERLACH

Subscribers can read Doug's complete commentary and the in-depth profile of our recommended small company stock in the January 2024 issue of the SmallCap Informer stock newsletter. Not a subscriber? Subscribe to the SmallCap Informer and get monthly small company stock recommendations and updated buy/sell prices for each of the 49 high-quality small company stocks currently covered in the newsletter.