|

Don't Make This Mistake When Pondering Economic Trends |

6/2/2024 |

A proper understanding of inflation and the health of the U.S. economy is key.

In a recent poll conducted by The Wall Street Journal, 56% of respondents believe that the U.S. economy has worsened over the past two years.

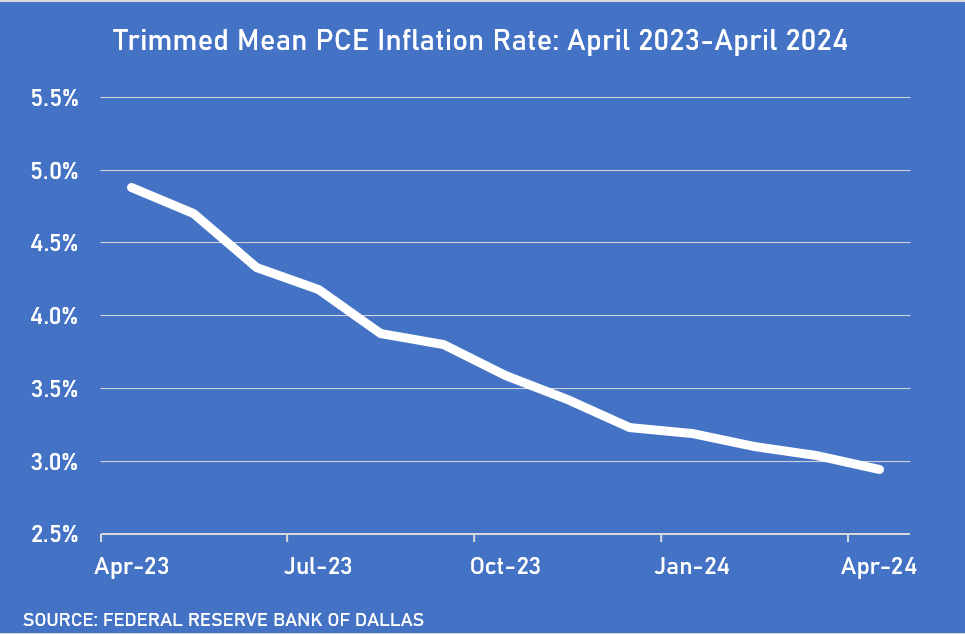

The truth about the state of the present economy, however, is anything but a story of dire times. More than a million jobs have been created. Inflation is trending downward. The stock market has performed well. Consumers are spending on travel, restaurants, and online shopping. And wages have increased even faster than inflation, more than offsetting rising prices.

Of course, your experience may vary. But this is the problem with replacing empirical data with personal perception—an individual can reach the wrong conclusion because of their personal cognitive biases. Unconscious modes of thought such as relying too heavily on personal observation often interfere with good decisionmaking, which is antithetical to successful investing.

Another explanation for why the majority of Americans are convinced that the economy is floundering is that they lack a basic understanding of what “inflation” actually means. “I hear that inflation is going down,” they say, “but prices are still going up at the grocery store.”

Time for an economics lesson. Inflation describes the general overall increase in the prices of goods and services. If inflation falls from 8% to 6% to 3%, it still means that prices are going up. It’s just that they were rising 8%, then 6%, and now are rising at a 3% rate—but prices are still increasing. For prices to return to levels seen in 2019 or 2020 deflation would need to take place, which would have negative consequences to the economy.

The Federal Reserve targets 2.0% as a low, stable inflation rate over the long term. This objective is predicated on the understanding that prices should and will rise over time. It does not mean that inflation will always be in this range, or that prices of all goods and services will match the measured rate of overall inflation.

One sad consequence of this mismatch of opinion and fact is something of a vicious circle, where consumer behavior is negatively affected by perception of the health of the economy, which in turn leads to real economic deterioration or delayed recovery.

Long-time subscribers will know that (for several years now) I have been—and remain—sanguine about the health of the overall economy and the risk of a recession. Within our coverage list, though, are a number of cyclical companies for which long-term prospects look good and valuations appear attractive.

Until more consumers get over their fears of imminent economic disaster, these companies will not see their shares gain much traction in the market and thus do not get much attention in our newsletter. It is better to be pragmatic than stubborn. Until then, all savvy investors can do is, as I like to say, stay the course!

In this june issue of the SmallCap Informer, we recommend for sale a company that is being acquired. While we would like to have seen a better price offered for the company, this is a good opportunity to exit the company, and we will be discontinuing coverage.

Our focus stock is one that we have covered before and that has delivered good returns relative to the market since introduced. The company is building a good foundation for future growth, with an eco-friendly bent as a bonus.

- DOUG GERLACH

Subscribers can read Doug's complete commentary and the in-depth profile of our recommended small company stock in the June 2024 issue of the SmallCap Informer stock newsletter. Not a subscriber? Subscribe to the SmallCap Informer and get monthly small company stock recommendations and updated buy/sell prices for each of the 47 high-quality small company stocks currently covered in the newsletter.