|

Is Your Club Portfolio Truly Focused on Growth? |

7/11/2024 |

Use this shortcut to see if your portfolio is positioned to achieve your return objectives.

For growth investors, capital appreciation driven by the underlying growth of the companies is the largest driver of total return. If a club isn’t focused strongly enough on investing in companies that are expected to grow sales and earnings over time, then the club’s returns may trail the market. (Not good!)

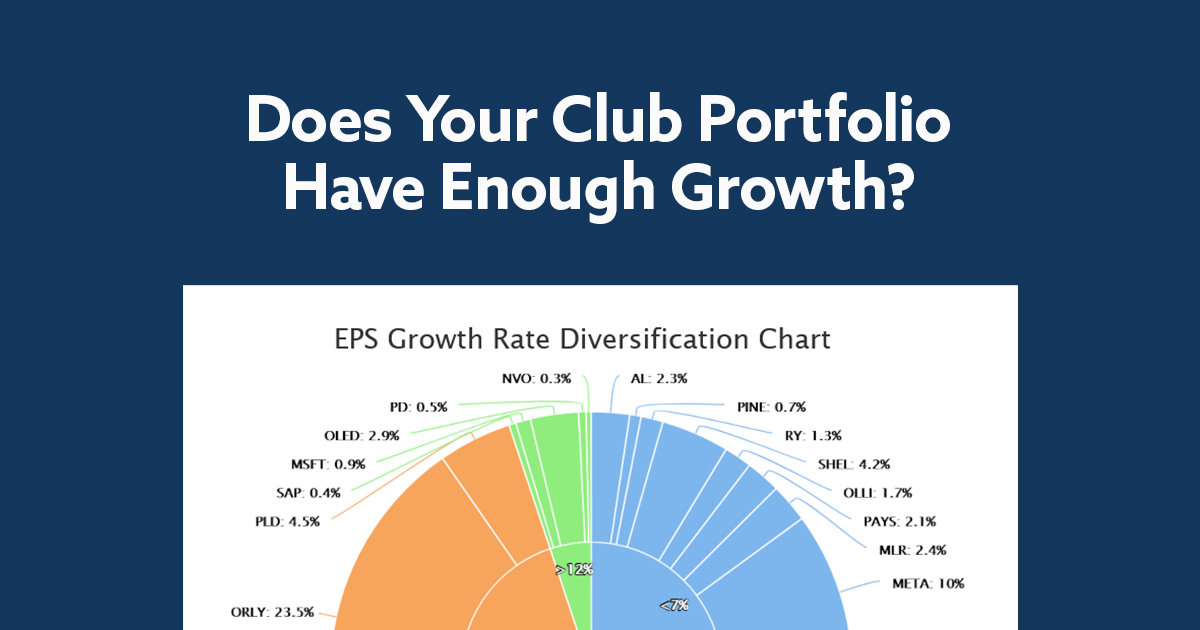

The myICLUB EPS Growth Rate Diversification and Graph can help club members evaluate the projected earnings per share (EPS) growth rate for each stock owned. Companies are categorized by five-year projected EPS growth rates, from a member’s linked Stock Selection Guide or from analysts’ estimates. Companies with expected growth greater than 12% a year represent the best opportunities for future return, while companies with growth between 7% and 12% could be solid holds due to unrealized gains or expected dividends. Companies with projected growth slower than 7% might be ripe for review, since even a robust dividend yield might not be able to drive adequate returns.

The Weighted Average EPS Growth Rate sums up the expected growth for the entire portfolio. If this figure is too far below 10% or 12% a year, the portfolio may not have enough horsepower to beat the market.

myICLUB.com is the world's most popular tool for investment club accounting and operations. Sign up for a free trial to see for yourself why thousands of investment clubs choose myICLUB.com to manage their club's books and operations.

For more on tools for investment club accounting, operations, and tax preparation, please visit https://www.myICLUB.com.